When Xiaomi launched the first Redmi Note in India in 2014, it changed the India smartphone market. The phone was affordable, powerful for its time, and easy to recommend. It did not try to be premium. It tried to offer the best value possible.

That first Redmi Note was also my phone. Like many others, I bought it because it offered more than anything else in its price segment. Over the years, I kept upgrading within the Redmi Note series. Newer models brought better displays, stronger processors, and improved cameras, while still staying within reach for most users.

This is how Xiaomi built its rise in India.

The Redmi Note series helped Xiaomi become the top smartphone brand in the country by volume. Flash sales sold out in minutes. Redmi phones reached smaller cities and towns faster than many competitors. Xiaomi understood Indian buyers well. It focused on specs, aggressive pricing, and wide availability. For a long time, the Redmi Note was the safest recommendation for anyone looking for value.

But that story has slowly changed.

Today, the Redmi Note series sits much closer to the near-premium segment. The recently launched Redmi note 15 series is priced alongside phones that buyers once considered aspirational. The REDMI Note 15 Pro+ 5G goes up to Rs. 43,999 for the 12GB + 512GB model. This is a big change from what the Note series originally stood for. We knew the Redmi Note series as a mid-range smartphone series offering value-for-money devices with aggressive pricing.

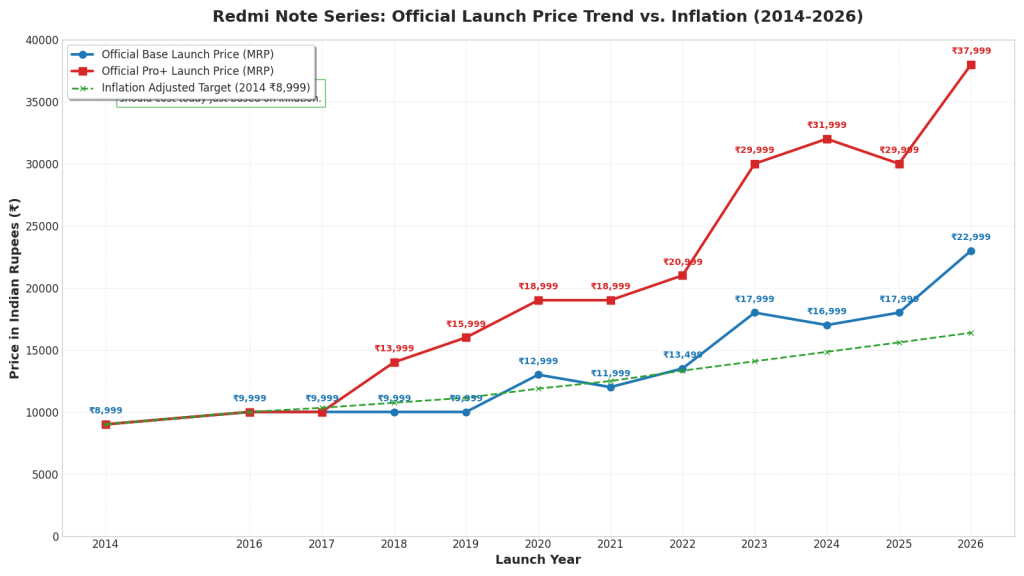

Here’s a price history graph that shows how we saw a sudden jump in 2022 and this year in 2026. It is also important to note that Xiaomi lost its top smartphone maker crown in India in Q4 2022. Before that, it helped the top sp[ot for 20 consecutive quarters (5 straight years) starting from late 2017. We can understand how price increase has negantively affected the sales.

There are genuine reasons for this price hike over the years. Smartphone components have become more expensive. Features like AMOLED displays, high refresh rates, multi-camera systems, fast charging, and 5G add to the cost. Manufacturing and compliance costs in India have also increased. Xiaomi is not alone in raising prices.

Still, pricing is not only about cost. It is also about identity.

The Redmi Note series was built on value, and people perceived it as a mid-range smartphone series. When prices move up too fast, long-time users start feeling disconnected. I felt the same. At some point, upgrading to a new Redmi Note no longer felt exciting or justified. The phone was good, but it was no longer an obvious value-for-money choice.

If Xiaomi wanted to target the segment above Rs. 30000, it could have named it something else. Redmi K series or Redmi Turbo series could have been a choice. But pushing the mid-range Redmi Note series to a premium segment is a bad move.

Xiaomi launches many models every year. Differences between variants are smaller. So, the lineup feels crowded and confusing. For buyers in higher price segments, specs alone are not enough. They expect better cameras, cleaner software, longer updates, and a more premium overall experience.

Now, the current segment where the Redmi Note lineup is trying to compete is not easy to crack. It has strong competition from brands like Samsung, Vivo, iQOO, Oppo, Nothing, Motorola, and others. Buyers have more choices, so brand recognition alone cannot carry a phone into a higher price bracket.

Xiaomi’s market share in India has seen pressure in recent years. The brand is no longer the clear disruptor it once was. Moving the Redmi Note series upmarket seems a bold move, but it has already risked the brand loyalty.

The Redmi Note became popular because it felt fair. It respected the buyer’s money. As it moves closer to near-premium territory, Xiaomi must clearly answer one question.

Is Redmi Note still about value, or is it now just a familiar name with a higher price?