India’s smartphone market has reached a major milestone and reduced its highest quarterly shipment volume in five years. According to IDC’s Worldwide Quarterly Mobile Phone Tracker, shipments grew by 4.3% year-over-year in the third quarter of 2025 and reached 48 million units. This growth comes at a time when the global smartphone market remains largely stagnant.

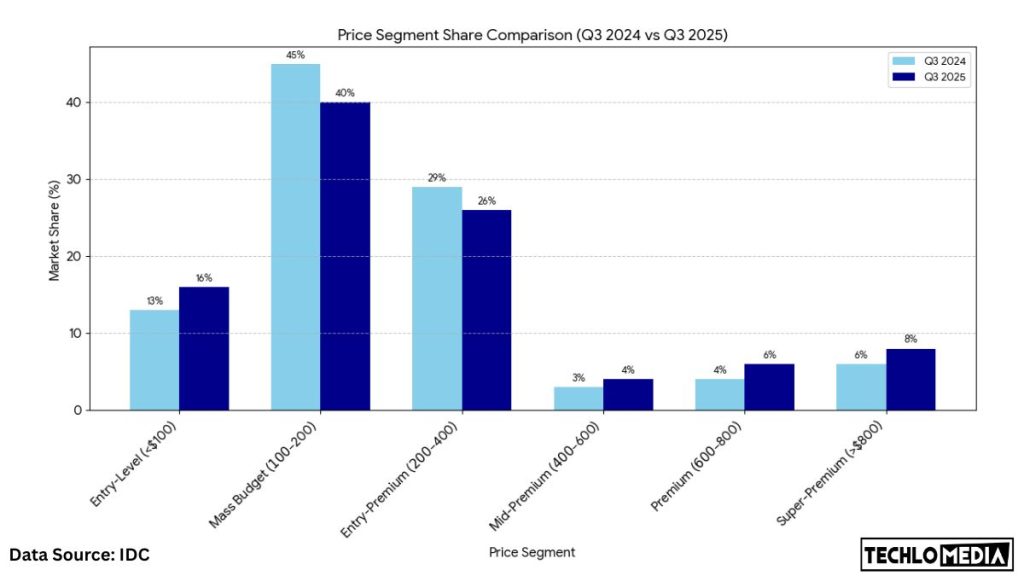

The growth in shipments was not just about volume, but about value. The average selling price of smartphones in India reached USD 294 (~ Rs. 26000), a significant 13.7% increase from last year. This shows that Indian consumers are now spending more on better quality devices rather than settling for budget options. While entry-level smartphones did see a small rise in demand, the larger story was the growing appetite for premium and super-premium models. This reflects how smartphones are increasingly viewed as long-term investments, offering better displays, performance, and ecosystem connectivity.

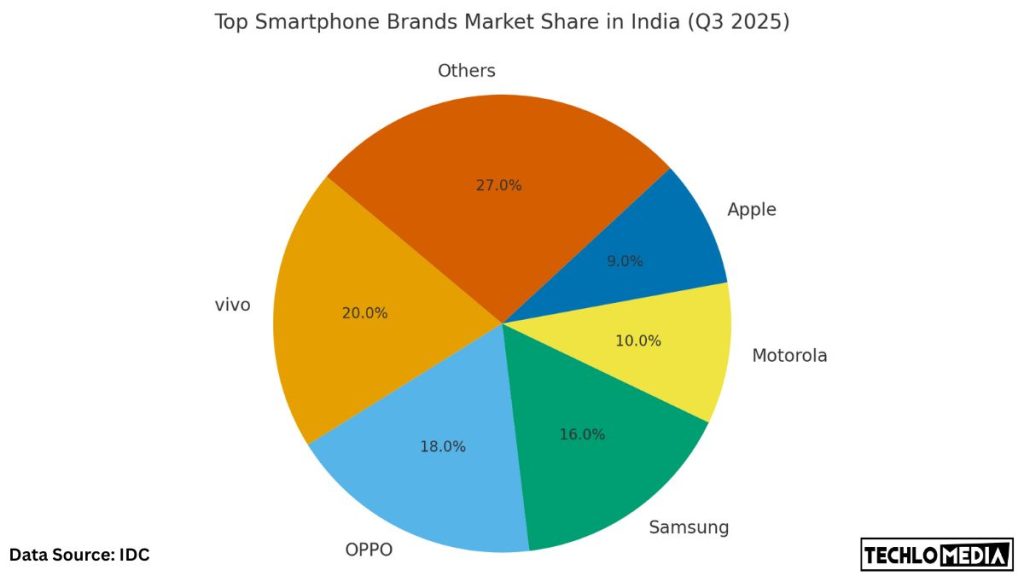

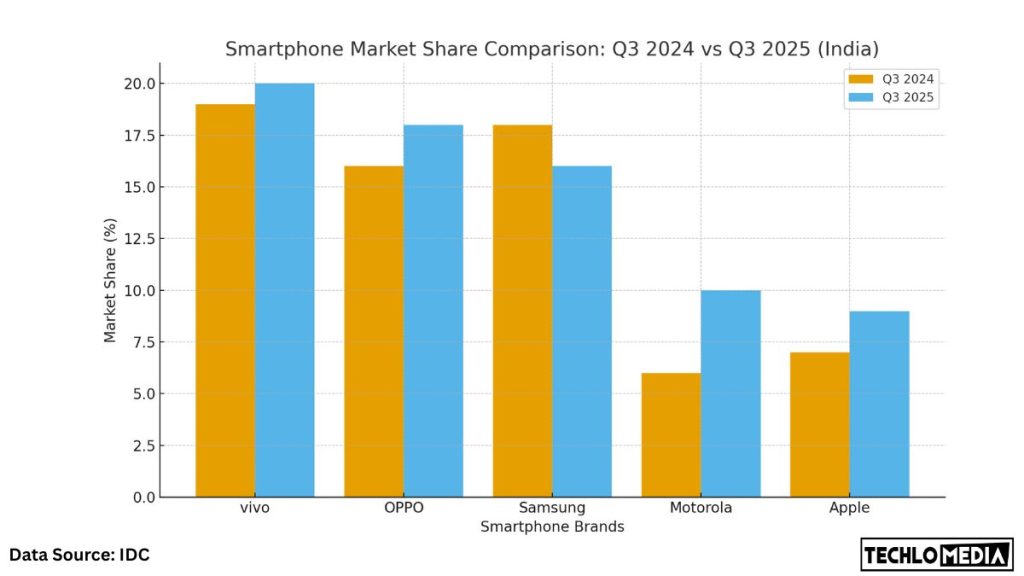

Vivo retained its position as the top smartphone brand in India for the seventh consecutive quarter. The company’s balanced presence across both offline and online channels helped it sustain its lead. OPPO climbed to second place by surpassing Samsung, thanks to aggressive offline initiatives and trade-in offers. Motorola was another big winner. It posted a remarkable 52.4% year-over-year growth driven by its strong mid-range portfolio. Apple also recorded an exceptional quarter, with shipments rising 25.6% to reach an all-time high of 5 million units. For the first time, Apple secured the fourth position in India’s smartphone rankings. This is a remarkable achievement considering its premium pricing.

Apple’s growth tells a deeper story about India’s changing consumer priorities. The iPhone 16 was the most-shipped device in the country, accounting for 5% of all smartphones sold in the quarter. Meanwhile, the newly launched iPhone 17 series and the iPhone Air contributed 16% of Apple’s quarterly shipments. This marks the company’s strongest launch quarter in India since 2021. This success was driven by consistent demand for both older discounted models and the latest premium variants.

The festive season was a major driver behind this surge. Online and offline retailers rolled out deep discounts, exchange programs, and flexible financing options to attract buyers. According to IDC’s Aditya Rampal, online sales of older Apple and Samsung flagship models played a critical role in pushing overall shipment volumes. However, the offline market emerged stronger this year, growing 21.8% year-over-year and capturing 56.4% of total sales. This growth was powered by brand-led retail expansion, improved trade margins, and targeted local promotions. Online platforms, in contrast, saw a 12% drop in shipments, indicating a shift in buyer confidence toward physical retail stores, especially for higher-value purchases.

In terms of price segments, the market’s polarization was clear. The entry-level segment (below USD 100) grew by 35.3%. It accounted for 16% of total shipments, with Xiaomi, realme, and vivo leading the charge. However, the mass-budget range (USD 100–200), which has traditionally been the largest, declined by nearly 9%. It shows how customers are moving upward. The mid-premium and premium ranges (USD 400–800) saw double-digit growth, while the super-premium category (above USD 800) jumped by an impressive 52.9%. Apple dominated this ultra-luxury tier with a 66% share, followed by Samsung at 31%. Models like the iPhone 16 Pro, Galaxy S24 Ultra, and Galaxy Z Fold7 drove most of this demand.

The chipset landscape also underwent a big change. Qualcomm-powered devices grew by 17.9% year-over-year and captured nearly 30% market share. This growth was driven by strong performance from Xiaomi, POCO, and Nothing phones. In contrast, MediaTek’s share fell from 53.1% to 46%. It shows that consumers are increasingly prioritizing performance, connectivity, and gaming efficiency.

Despite the robust quarter, IDC warns that the coming months may not be as strong. Upasana Joshi, Senior Research Manager at IDC Asia Pacific, noted that while festive promotions and financing options boosted Q3 shipments, much of the demand was concentrated in premium devices. The mid-tier and mass-market categories are still under pressure, and there are signs of inventory buildup heading into the final quarter of the year. Rising memory costs and currency fluctuations are also expected to push prices up after Diwali. IDC forecasts that Q4 2025 could see a slight year-over-year decline, with total annual shipments expected to fall below 150 million units.

Overall, India’s smartphone market is entering a new era. The combination of rising purchasing power, premiumization trends, and growing offline reach has made it one of the most dynamic smartphone markets in the world. While challenges such as price volatility and uneven demand remain, the long-term outlook remains positive. The data from Q3 2025 clearly shows that Indian consumers are moving toward better technology, stronger ecosystems, and brands that deliver consistent value. This change will continue shaping the country’s digital economy for years to come.